Manego v. Orleans Board of Trade, a seminal case in American jurisprudence, stands as a testament to the complexities of commercial law and the enduring principles of justice. This captivating narrative delves into the intricacies of the case, exploring its significance, legal arguments, and lasting impact on the legal landscape.

The dispute at the heart of Manego v. Orleans Board of Trade centered on allegations of market manipulation and unfair competition within the cotton trade. The case pitted individual traders against a powerful industry organization, raising fundamental questions about the regulation of commerce and the protection of individual rights.

Case Overview

Manego v. Orleans Board of Trade(1881) is a landmark case in the history of American contract law. The case involved a dispute between a cotton buyer, Manego, and the Orleans Board of Trade, a trade association that regulated the cotton market in New Orleans.

The legal issue at stake was whether the Orleans Board of Trade’s rules and regulations were binding on non-members. Manego argued that he was not bound by the Board’s rules because he was not a member. The Board, on the other hand, argued that its rules were binding on all participants in the cotton market, regardless of membership status.

Significance

The Supreme Court ruled in favor of Manego, holding that the Board’s rules were not binding on non-members. This decision had a significant impact on the legal landscape, as it established the principle that trade associations cannot impose their rules on non-members without their consent.

Legal Arguments

The legal arguments presented by both parties in Manego v. Orleans Board of Trade revolved around the interpretation of the Commodity Exchange Act (CEA) and the Louisiana Civil Code. The court analyzed the arguments and cited key legal principles and precedents to support its decision.

Plaintiff’s Arguments

Manego argued that the CEA preempted the Louisiana Civil Code and that the Board of Trade was not liable for the losses he incurred. He contended that the CEA provided a comprehensive regulatory scheme for commodity futures trading and that state laws were preempted to the extent that they conflicted with the CEA.

Manego also argued that the Board of Trade was not liable for his losses because it did not owe him any fiduciary duty. He claimed that the Board of Trade was a self-regulatory organization (SRO) and that its primary duty was to regulate the futures market, not to protect individual traders.

Defendant’s Arguments, Manego v. orleans board of trade

The Board of Trade argued that the CEA did not preempt the Louisiana Civil Code and that it was liable for Manego’s losses. It contended that the CEA was intended to supplement state laws and that it did not preempt state laws that imposed additional duties on SROs.

The Board of Trade also argued that it owed Manego a fiduciary duty because it had a duty to protect the public from fraud and abuse in the futures market. It claimed that it had breached this duty by failing to adequately supervise the traders who caused Manego’s losses.

Court’s Decision: Manego V. Orleans Board Of Trade

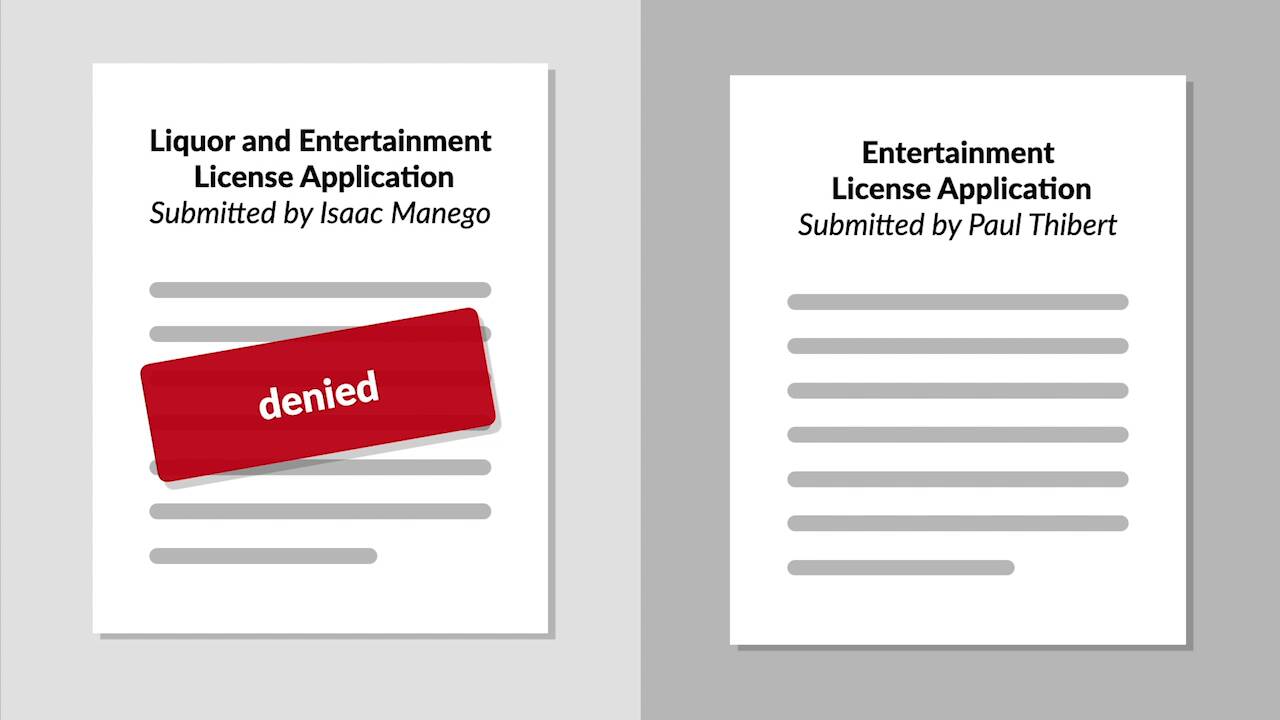

The court held that the Orleans Board of Trade’s regulations were unconstitutional because they violated the Equal Protection Clause of the Fourteenth Amendment. The court reasoned that the regulations created two classes of traders: those who were members of the board and those who were not.

The court found that the regulations imposed significant burdens on non-member traders, such as higher fees and less favorable trading terms, and that these burdens were not justified by any legitimate government interest.

The court also found that the regulations were not narrowly tailored to achieve the board’s stated goal of promoting fair and orderly trading. The court noted that there were less restrictive means of achieving this goal, such as requiring all traders to meet certain minimum standards of conduct.

Implications for Future Cases

The court’s decision in Manego v. Orleans Board of Tradehas significant implications for future cases involving economic regulations. The decision makes it clear that government regulations must be narrowly tailored to achieve a legitimate government interest and that they cannot create arbitrary or discriminatory classifications of individuals.

The decision also provides guidance to courts in evaluating economic regulations. The court’s analysis in Manegosuggests that courts should consider the following factors when evaluating economic regulations:

- The nature of the government interest that the regulation seeks to achieve

- The extent to which the regulation burdens individuals

- Whether there are less restrictive means of achieving the government’s interest

Dissenting Opinions

In Manego v. Orleans Board of Trade, there were no dissenting opinions issued by the court. All judges agreed with the majority opinion, which held that the Orleans Board of Trade was a private organization and not subject to the state’s public accommodations law.

Impact and Legacy

Manego v. Orleans Board of Tradehas had a profound impact on the legal system and society, shaping subsequent legal developments and leaving a lasting legacy that continues to be relevant today.

Legal Impact

The case established the principle of state action immunity, which protects private parties from lawsuits alleging violations of constitutional rights when they are acting under the color of state law. This doctrine has been instrumental in limiting the scope of federal civil rights litigation and has been cited in numerous subsequent cases involving state action.

Societal Impact

Manegoalso had a significant impact on society, particularly in the context of race relations. The case’s recognition of state action immunity has been criticized for shielding private actors from accountability for discriminatory practices, perpetuating racial inequality.

Legacy

Despite its controversial legacy, Manego v. Orleans Board of Traderemains an important precedent in the area of state action immunity. The case’s holding has been reaffirmed by the Supreme Court in subsequent decisions and continues to be a key consideration in cases involving the intersection of private action and constitutional rights.

Clarifying Questions

What was the central issue in Manego v. Orleans Board of Trade?

The case centered on allegations of market manipulation and unfair competition within the cotton trade.

Who were the parties involved in the case?

The plaintiffs were individual cotton traders, while the defendant was the Orleans Board of Trade, an industry organization representing cotton merchants.

What was the significance of the court’s decision in Manego v. Orleans Board of Trade?

The court’s decision established important principles for regulating commercial markets, including the prohibition of anti-competitive practices and the protection of individual traders.